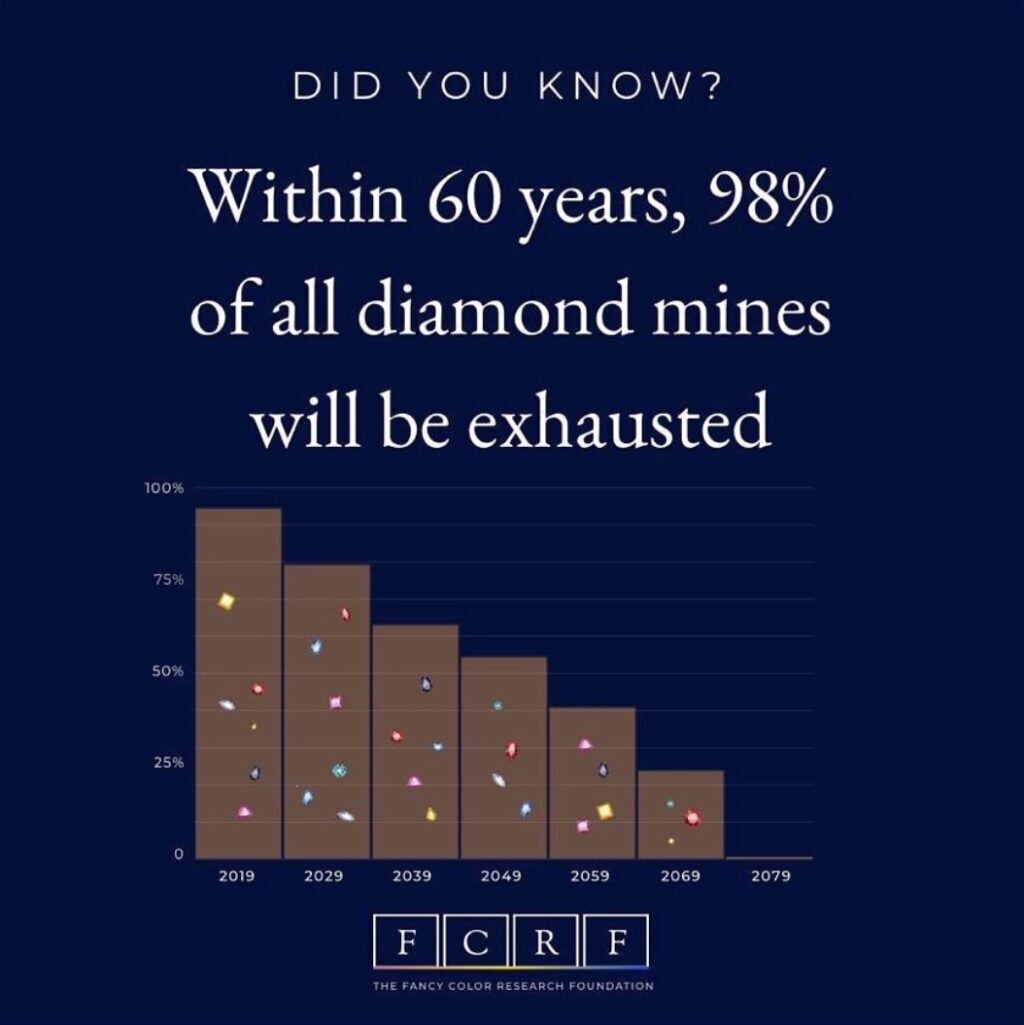

“The last diamond unearthed: The countdown is on.”

– The Fancy Color Research Foundation

Protect and increase your wealth

Rare diamonds have captivated the human imagination for centuries, not only for their timeless beauty but also for their potential as a unique investment asset, as well as a hedge against financial and political crisis as we experience right now with banking collapses, inflation, increased interest rates and the ongoing conflicts.

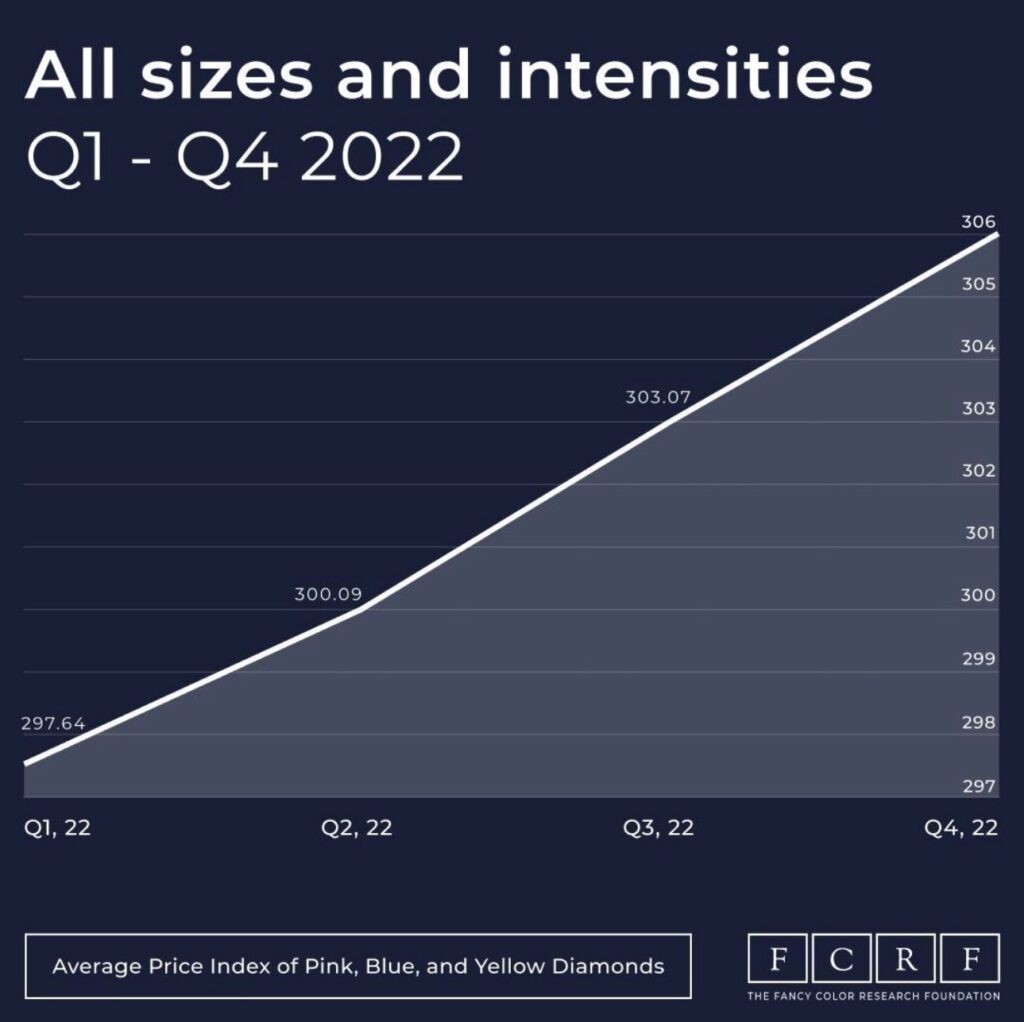

The rare diamond market has witnessed notable growth and stability over the years. The demand for exclusive, high-quality diamonds has consistently driven the market, making rare diamonds a sought-after commodity for investors. In recent years, the market has shown resilience, even in times of economic uncertainty, underlining the enduring allure and value of rare diamonds as an alternative investment.